Avoiding Financial Burden: Are Private Student Loans Dischargeable?

Are private student loans dischargeable? If you’re struggling to make payments on a private student loan, this question may have kept you up at night. You’re not alone – millions of students and graduates are facing the financial burden of high-interest debt, making it difficult to achieve their long-term goals.

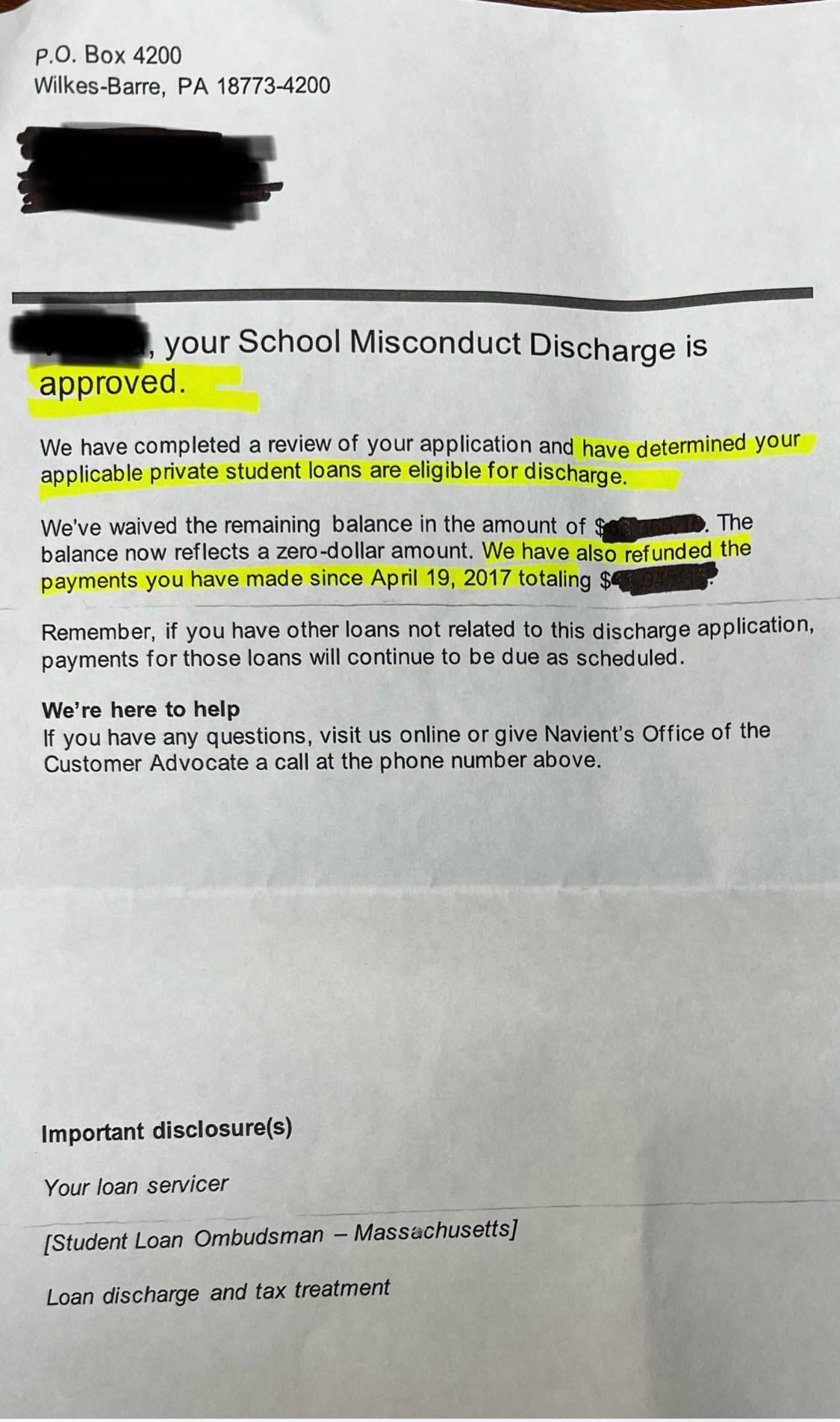

The uncertainty surrounding private student loan discharge can be overwhelming. Can these loans be forgiven in bankruptcy? Are there any exceptions or alternatives to consider? In this article, we’ll delve into the complexities of private student loan discharge and provide valuable insights to help you navigate this challenging situation.

Avoiding Financial Burden: Are Private Student Loans Dischargeable?

Are private student loans dischargeable? If you’re struggling to make payments on a private student loan, this question may have kept you up at night. You’re not alone – millions of students and graduates are facing the financial burden of high-interest debt, making it difficult to achieve their long-term goals.

The uncertainty surrounding private student loan discharge can be overwhelming. Can these loans be forgiven in bankruptcy? Are there any exceptions or alternatives to consider? To understand the answer, let’s start by looking at how bankruptcy works for federal student loans.

Federal student loans, such as Direct Loans and Federal Family Education Loans (FFEL), are generally considered dischargeable in bankruptcy. However, private student loans are a different story. Private lenders have more lenient requirements for discharging these debts in bankruptcy, making it much harder to get rid of the debt.

Under the “undue hardship” provision, borrowers can petition to discharge their private student loan debt if they can demonstrate that repaying the loan would cause them significant financial distress. This provision is rarely granted and requires a thorough examination of the borrower’s financial situation, including their income, expenses, and credit history.

Another option for dealing with private student loans is refinancing or consolidation. Refinancing involves replacing your existing loan with a new one that has better terms, such as a lower interest rate or longer repayment period. Consolidation combines multiple loans into one loan with a single interest rate and monthly payment.

To learn more about discharging private student loans in bankruptcy, check out the National Consumer Law Center’s guide. Additionally, the Federal Student Aid website provides detailed information on student loan discharge and bankruptcy.

Get Your Student Loan Discharge Questions Answered

Don’t let private student loans hold you back – start your journey to financial freedom today!

Start Free Chat

Start Free Chat

Frequently Asked Questions

Q: What does it mean for private student loans to be dischargeable?

A: Dischargeable debt refers to the cancellation or forgiveness of a loan due to certain circumstances, such as bankruptcy, death, or permanent disability. In the context of private student loans, dischargeability means that the loan can be forgiven or discharged under specific conditions.

Conclusion

In conclusion, private student loans are not as easily dischargeable as federal student loans. To have a private student loan discharged in bankruptcy, borrowers must demonstrate “undue hardship,” which is a high bar to clear. Additionally, refinancing or consolidation may be viable options for managing private student loan debt.

It’s essential to understand the differences between private and federal student loans when navigating debt relief strategies. By exploring the nuances of private student loan discharge and considering alternative solutions, individuals can better manage their financial burdens and work towards achieving their long-term goals.

Get Same Day Payday Loan Online in Texas: Are you facing an unexpected expense in Texas? Our same day payday loan online solution provides quick cash to help you overcome financial emergencies. Learn more about how to get same day payday loans in Texas and take control of your finances today!