Best Student Loan Refinance of 2017: Take Control of Your Finances

Are you tired of being burdened by high-interest rates on your student loans? You’re not alone. Millions of students and graduates are struggling to make ends meet, with debt from college expenses weighing them down. The good news is that there are options available to help you refinance your student loan and take control of your finances.

Student Loan Refinancing: What’s the Best Option for You?

If you’re considering refinancing your student loan, you want to make sure you’re getting the best deal possible. With so many options available, it can be overwhelming to choose the right one. That’s why we’ve compiled a list of the best student loan refinance companies of 2017, based on factors such as interest rates, fees, and customer service.

Best Student Loan Refinance of 2017: Take Control of Your Finances

Are you tired of being burdened by high-interest rates on your student loans? You’re not alone. Millions of students and graduates are struggling to make ends meet, with debt from college expenses weighing them down (1). The good news is that there are options available to help you refinance your student loan and take control of your finances.

Student Loan Refinancing: What’s the Best Option for You?

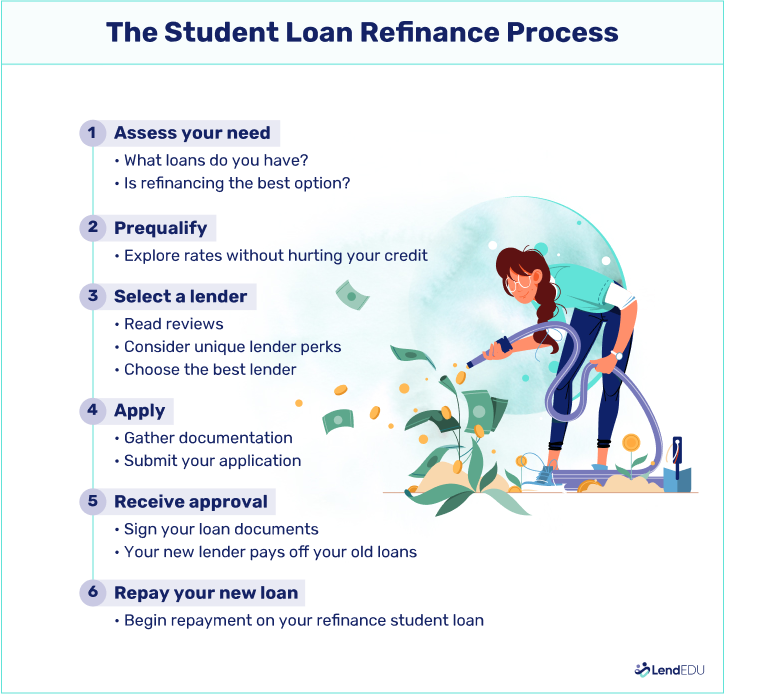

If you’re considering refinancing your student loan, you want to make sure you’re getting the best deal possible. With so many options available, it can be overwhelming to choose the right one (2). That’s why we’ve compiled a list of key factors to consider when refinancing your student loan, including interest rates, fees, and customer service.

Refinance Your Student Loans Today!

Don’t let high-interest student loans hold you back any longer. Discover the best student loan refinance options and start saving money today! 💰

💬 Start Free ChatFrequently Asked Questions

Q: What is student loan refinancing?

A: Student loan refinancing involves replacing one or more existing federal or private student loans with a new loan that has a lower interest rate, longer repayment term, or other benefits. This can help borrowers save money on interest payments and simplify their loan debt.

Conclusion

Refinancing your student loan can be a game-changer for those struggling with high-interest debt. By understanding the key factors to consider and making an informed decision, you can take control of your finances and start building a brighter financial future.

Same Day Payday Loans Online No Credit Check Direct Lenders Available: Get access to same day payday loans online without the need for a credit check. These direct lenders offer quick and easy applications, with no hidden fees or charges.