Calculate Your Personal Loan Monthly Interest Rates Today

Are you struggling to make ends meet due to the burden of personal loan debt? You’re not alone. Millions of people take out personal loans each year, but many are unaware of the true cost of borrowing until it’s too late. The interest rates on these loans can add up quickly, making it difficult to pay off the principal amount.

Understanding Personal Loan Interest Rates

A personal loan is a type of unsecured debt that allows you to borrow a lump sum of money and repay it over time. The interest rate on these loans can vary widely, depending on your credit score, loan amount, and repayment term.

In this article, we’ll show you how to calculate your personal loan monthly interest rates today. By understanding the true cost of borrowing, you’ll be better equipped to make informed decisions about your debt and take control of your financial future.

Calculate Your Personal Loan Monthly Interest Rates Today

Are you struggling to make ends meet due to the burden of personal loan debt? You’re not alone. Millions of people take out personal loans each year, but many are unaware of the true cost of borrowing until it’s too late. The interest rates on these loans can add up quickly, making it difficult to pay off the principal amount.

Understanding Personal Loan Interest Rates

A personal loan is a type of unsecured debt that allows you to borrow a lump sum of money and repay it over time. The interest rate on these loans can vary widely, depending on your credit score, loan amount, and repayment term.

The interest rate is typically expressed as an annual percentage rate (APR), which represents the total amount of interest paid over the life of the loan. For example, a personal loan with an APR of 15% would mean that you’ll pay $15 in interest for every $100 borrowed over the course of one year.

When calculating your monthly interest rates, it’s essential to consider the compounding frequency as well. This refers to how often the interest is added to the principal amount. For instance, if the interest is compounded daily or monthly, you’ll need to take that into account when calculating your monthly interest rate.

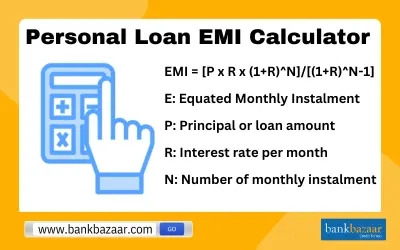

To calculate your personal loan monthly interest rates today, you can use a simple formula:

Monthly Interest Rate = (Annual Percentage Rate / 12)

For example, if the APR is 15%, your monthly interest rate would be:

(15% / 12) = 1.25%

Keep in mind that this is a simplified calculation and doesn’t take into account compounding frequency or other factors that may affect the interest rate.

Learn more about annual percentage yield (APY), which can help you better understand how your personal loan interest rates are calculated.Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a personal loan monthly interest rate?

A: A personal loan monthly interest rate is the amount of interest charged on your loan each month, expressed as a percentage. It’s an important factor to consider when evaluating different loan options.

-

Q: How do I calculate my personal loan monthly interest rate?

A: To calculate your personal loan monthly interest rate, you’ll need to know the annual percentage rate (APR) and the number of days in the month. The formula is: Monthly Interest Rate = APR / 12 * Number of Days in Month.

-

Q: What factors affect my personal loan monthly interest rate?

A: Your credit score, loan term, and the lender’s interest rates can all impact your personal loan monthly interest rate. A good credit score may qualify you for a lower interest rate, while a longer loan term may result in a higher overall interest paid.

-

Q: Can I negotiate my personal loan monthly interest rate?

A: In some cases, yes. If you have good credit or are negotiating with multiple lenders, you may be able to secure a lower interest rate. However, this is not always possible, and some lenders may not offer significant discounts.

-

Q: How can I use my personal loan monthly interest rate effectively?

A: Knowing your monthly interest rate can help you budget and plan for your loan payments. You can also use this information to compare different loan offers and choose the one that best fits your financial situation.

Conclusion

Now that you’ve learned how to calculate your personal loan monthly interest rates today, you’re better equipped to make informed decisions about your debt. Understanding the true cost of borrowing can help you avoid financial pitfalls and achieve your long-term goals.

Remember, knowing your monthly interest rate is crucial for budgeting and planning for your loan payments. By taking control of your personal loan debt, you’ll be able to make progress towards a more financially stable future.

Negotiate a settlement for your outstanding debt: Learn how to effectively negotiate with creditors and pay off debts quickly. Discover the strategies and techniques to reduce your debt burden and take control of your finances.