Can I Get a Student Loan Consolidation with Chapter 13?

If you’re struggling to make ends meet due to financial difficulties or overwhelming debt, you’re not alone. Many individuals face this challenge every year, and it can be especially daunting for those with student loans. However, did you know that you might be able to get a student loan consolidation even if you’re in the midst of a Chapter 13 bankruptcy? In this article, we’ll explore the possibilities and implications of consolidating your student loans while under Chapter 13 protection.

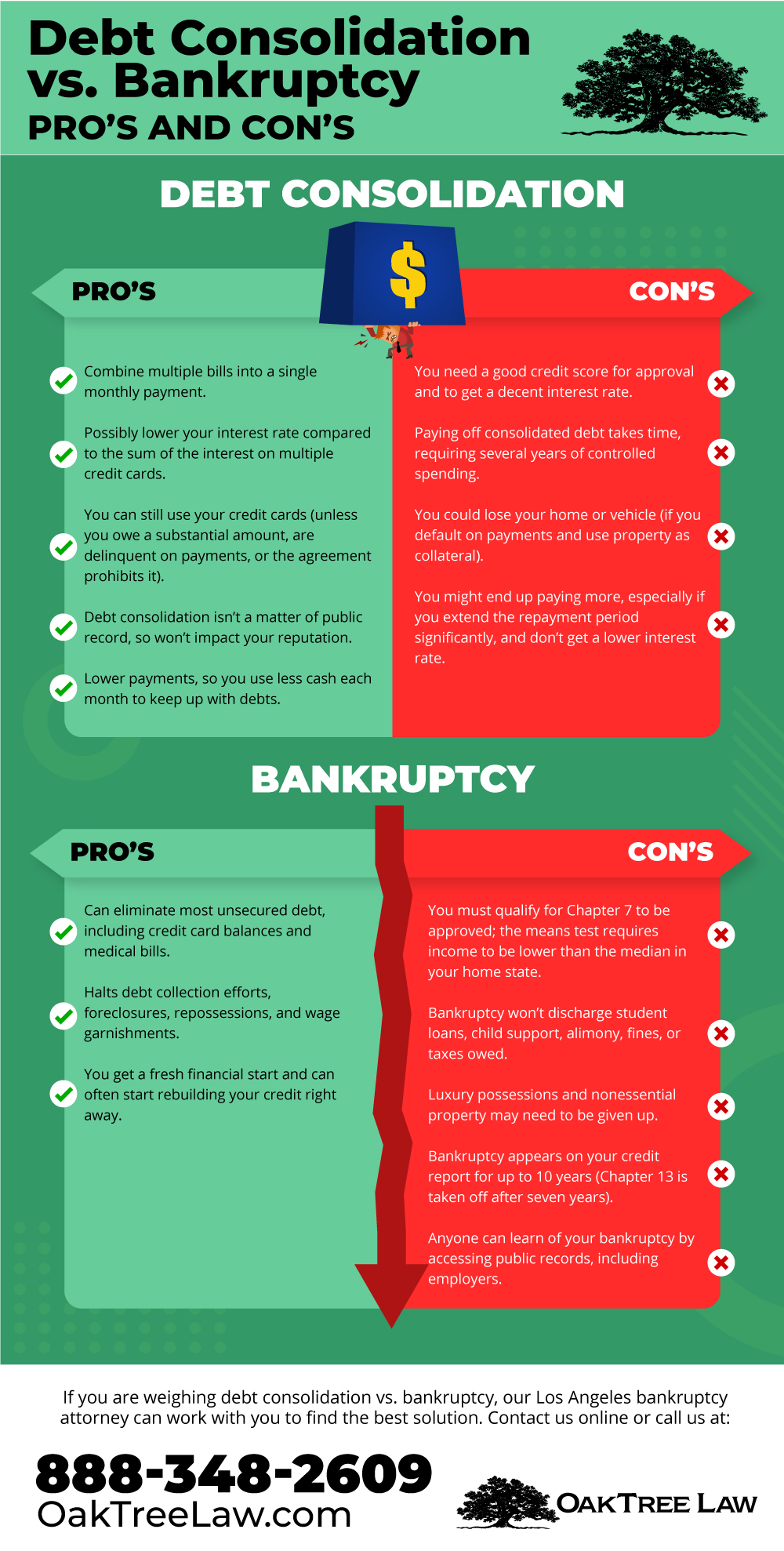

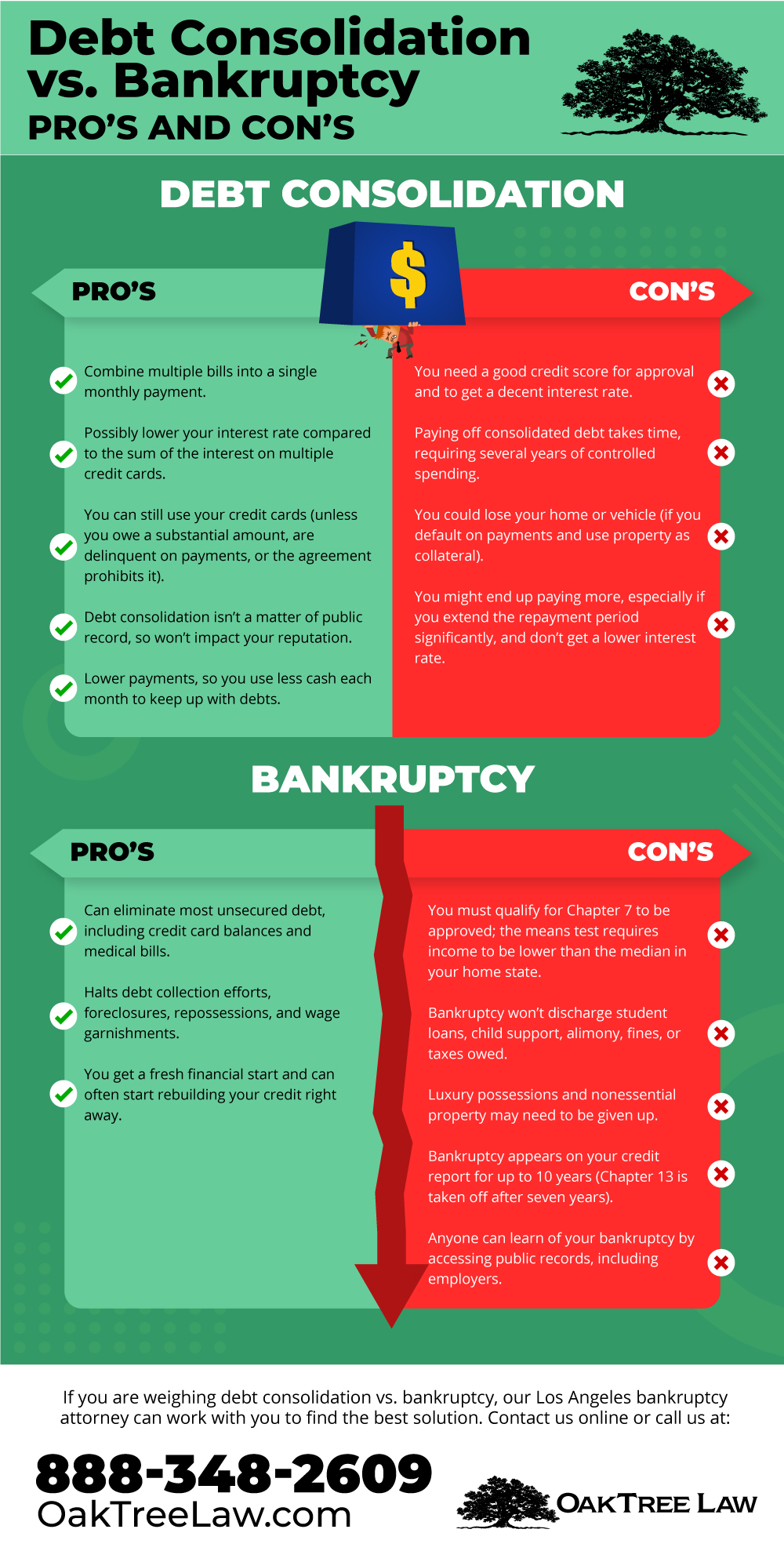

As someone dealing with debt, you may have heard of Chapter 13 bankruptcy, which allows individuals to reorganize their debts into a single monthly payment. But what happens if you also have student loans that are causing you stress? Can you consolidate them alongside your other debts, or do they follow different rules?

In this introduction, we’ll delve into the world of student loan consolidation and Chapter 13 bankruptcy, exploring the possibilities and limitations for those seeking relief from their student debt.

Can I Get a Student Loan Consolidation with Chapter 13?

If you’re struggling to make ends meet due to financial difficulties or overwhelming debt, you’re not alone. Many individuals face this challenge every year, and it can be especially daunting for those with student loans (1). However, did you know that you might be able to get a student loan consolidation even if you’re in the midst of a Chapter 13 bankruptcy? In this article, we’ll explore the possibilities and implications of consolidating your student loans while under Chapter 13 protection (2).

As someone dealing with debt, you may have heard of Chapter 13 bankruptcy, which allows individuals to reorganize their debts into a single monthly payment. But what happens if you also have student loans that are causing you stress? Can you consolidate them alongside your other debts, or do they follow different rules (3)?

In this introduction, we’ll delve into the world of student loan consolidation and Chapter 13 bankruptcy, exploring the possibilities and limitations for those seeking relief from their student debt.

Don’t Know if You Can Get a Student Loan Consolidation with Chapter 13?

Get expert guidance from our knowledgeable agents! 💬 Start Free Chat

💬 Start Free ChatFrequently Asked Questions

Q: What is the difference between student loan consolidation and refinancing?

A: Student loan consolidation combines multiple federal student loans into one loan with a single interest rate, payment, and due date. Refinancing involves replacing existing loans with new ones at a lower interest rate or different terms. Consolidation does not always require a credit check, while refinancing typically does.

Conclusion

In conclusion, while Chapter 13 bankruptcy provides a mechanism for individuals to reorganize their debts into a single monthly payment, student loan consolidation can still be an option even during this process. However, it’s essential to note that the process of consolidating your student loans may involve additional steps and requirements, such as obtaining court approval or meeting specific financial criteria.

It’s also important to remember that each individual’s financial situation is unique, and what works for one person may not work for another. As a result, it’s crucial to consult with a qualified financial advisor or attorney who can provide personalized guidance on navigating the complex landscape of student loan consolidation and Chapter 13 bankruptcy.

Same day cash online payday loan – get quick approval: Need a same-day cash advance? This article reveals the secrets to getting approved quickly, even with bad credit. Don’t miss out on this opportunity to access fast and convenient payday loans online.