Can I Still Deduct Student Loan Interest?

If you’re like many Americans struggling to pay off student loans, you may be wondering if you can still deduct the interest from your taxes. With the rising cost of higher education and increasing debt burdens, it’s no wonder you’d want to take advantage of every available tax break.

Unfortunately, recent changes to tax laws have made it more challenging for students and borrowers to deduct student loan interest on their tax returns. But before you give up hope, let’s dive into the details and explore your options.

In this article, we’ll answer the burning question: Can I still deduct student loan interest? We’ll also cover what has changed in recent years, who is affected, and how to navigate the new rules to minimize your tax liability.

Can I Still Deduct Student Loan Interest?

If you’re like many Americans struggling to pay off student loans, you may be wondering if you can still deduct the interest from your taxes. With the rising cost of higher education and increasing debt burdens, it’s no wonder you’d want to take advantage of every available tax break (1).

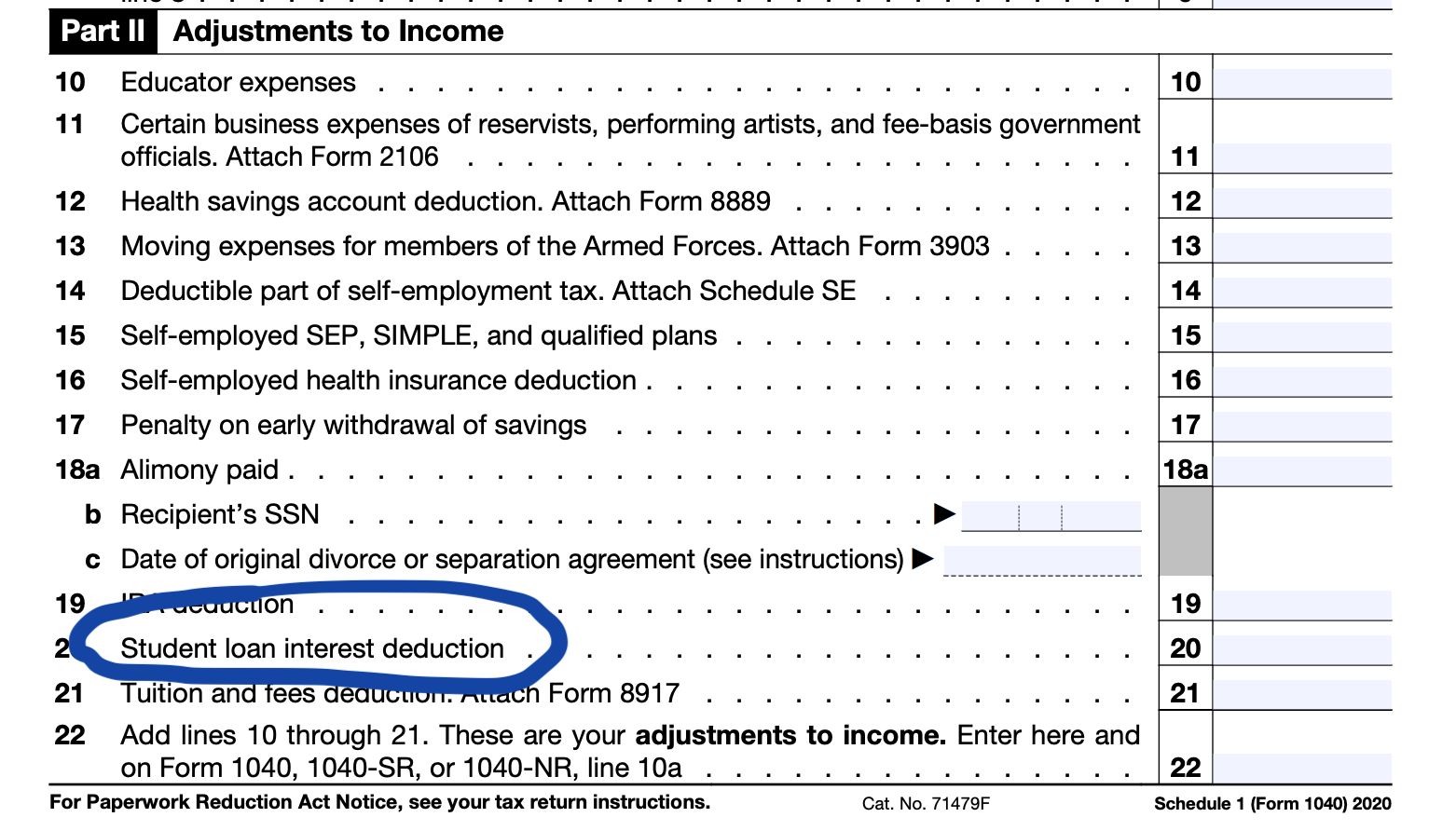

The American Opportunity Tax Credit (AOTC) was once the go-to provision for student loan interest deductions. However, as part of the Tax Cuts and Jobs Act (TCJA), this credit has undergone significant changes. Now, students and borrowers may find it more difficult to deduct their student loan interest (2).

The good news is that some individuals still qualify for the deduction. To determine if you’re eligible, let’s break down what has changed and who is affected.

This article will provide a comprehensive overview of the recent changes to student loan interest deductions, including the impact on students, borrowers, and taxpayers alike. We’ll delve into the details and explore your options for minimizing your tax liability (3). Let’s get started!

Got Questions About Student Loan Interest?

Uncertain if you can still deduct student loan interest? Let’s chat and get clarity on your options!

💬 Start Free ChatFrequently Asked Questions

What is student loan interest?

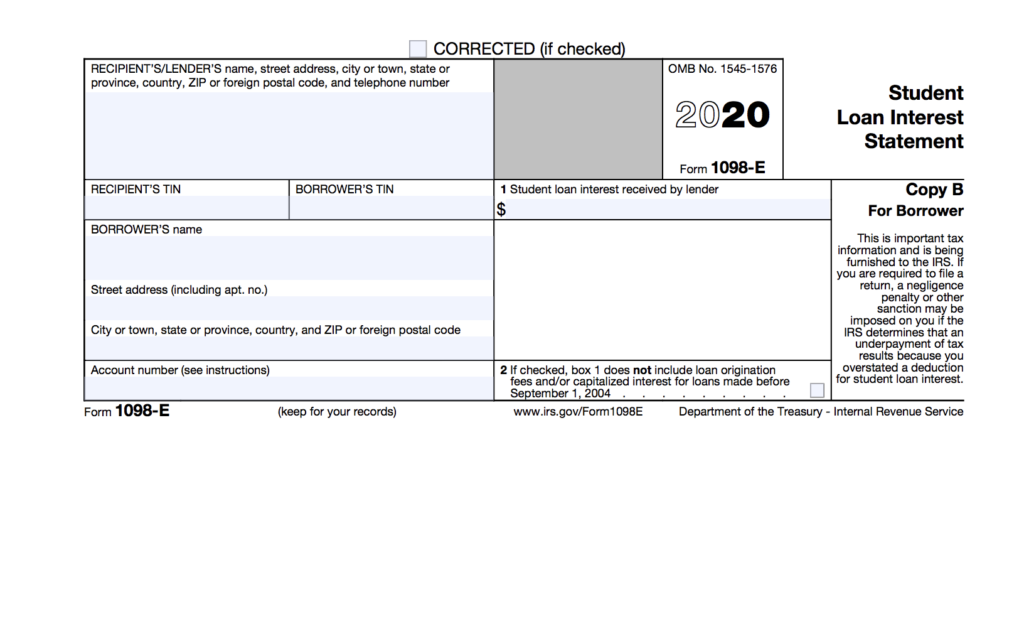

Student loan interest refers to the amount of money you pay each year as interest on your federal or private student loans. This includes both subsidized and unsubsidized loans.

In recent years, changes to tax laws have made it more challenging for students and borrowers to deduct student loan interest on their tax returns. However, with the right understanding of what has changed and who is affected, you can still navigate the new rules to minimize your tax liability.

As we explored earlier, the American Opportunity Tax Credit (AOTC) underwent significant changes as part of the Tax Cuts and Jobs Act (TCJA). Although it may be more difficult for some individuals to deduct their student loan interest, there are still options available for those who qualify.

In this conclusion, we’ve summarized the key points and provided a comprehensive overview of the recent changes to student loan interest deductions. By understanding what has changed and who is affected, you can make informed decisions about your tax strategy and maximize your savings.

Same day direct tribal payday loans quick cash solution for your urgent needs: Need a same-day loan with no credit check? This article reveals the secret to getting instant cash without waiting. Click here to learn more!