A Comprehensive Guide to Free Personal Loan Statement Template

Are you struggling to manage your personal finances? Do you find yourself constantly juggling multiple loan payments with different interest rates and repayment terms? You’re not alone! Many individuals face this challenge, which can lead to financial stress and anxiety. In fact, a recent survey found that over 60% of Americans have debt, with the average individual owing around $30,000.

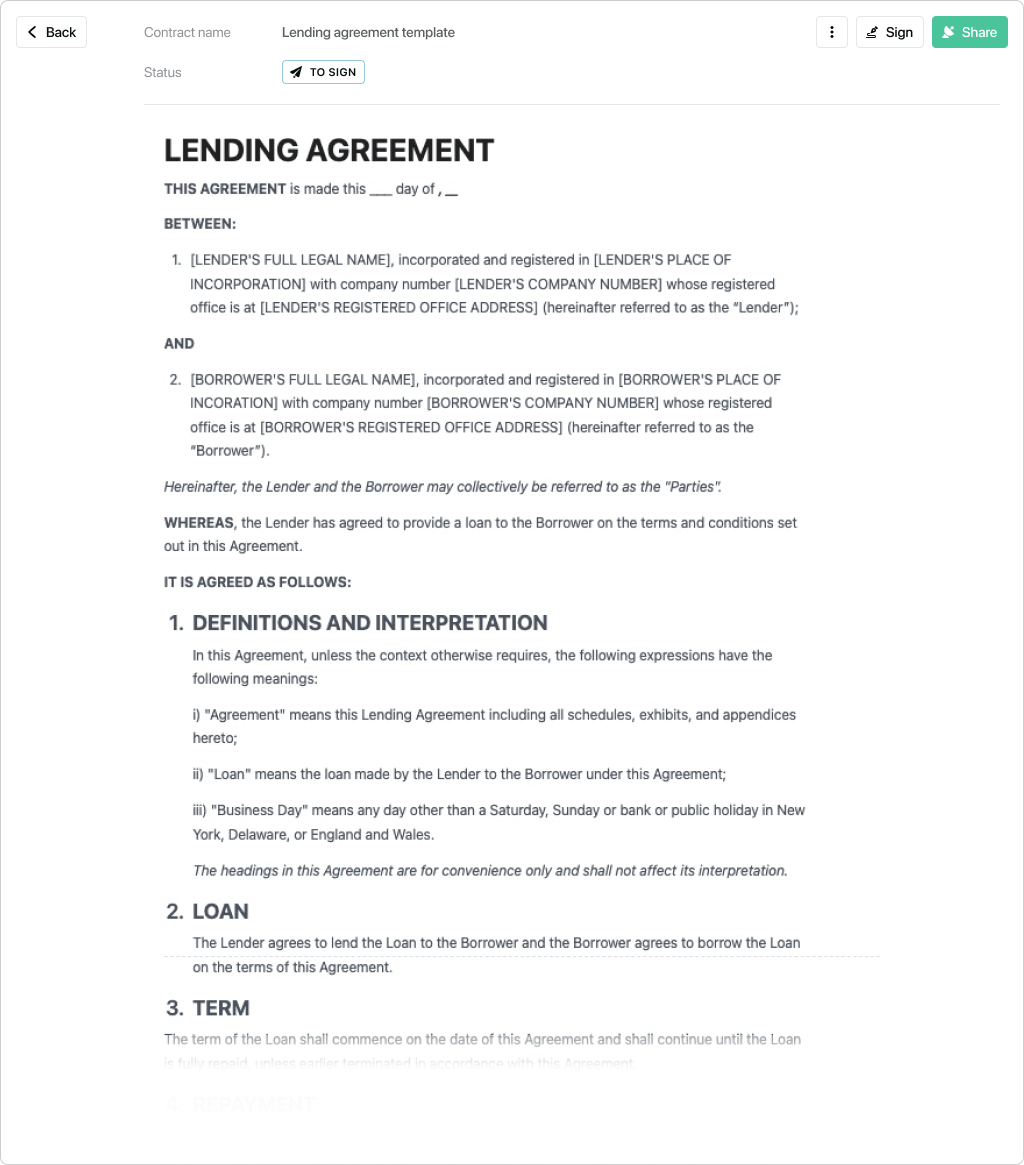

One effective way to take control of your finances is by creating a comprehensive loan statement template. This document outlines all your outstanding loans, including the principal amount, interest rate, and repayment schedule. Having this information organized can help you prioritize your debts, create a budget, and make informed decisions about your financial future.

In this guide, we’ll provide you with a free personal loan statement template that you can customize to suit your needs. We’ll also walk you through the steps to complete the template effectively, ensuring you have a clear understanding of your financial situation and can create a plan to achieve debt freedom.

What You’ll Learn:

- A step-by-step guide to creating a personal loan statement template

- The importance of tracking your loans and expenses

- Tips for prioritizing your debts and creating a budget

- A free, customizable loan statement template

In the next section, we’ll dive deeper into the benefits of using a loan statement template and provide you with the tools to get started.

A Comprehensive Guide to Free Personal Loan Statement Template

Are you struggling to manage your personal finances? Do you find yourself constantly juggling multiple loan payments with different interest rates and repayment terms? You’re not alone! Many individuals face this challenge, which can lead to financial stress and anxiety. In fact, a recent survey found that over 60% of Americans have debt, with the average individual owing around $30,000 [1].

One effective way to take control of your finances is by creating a comprehensive loan statement template. This document outlines all your outstanding loans, including the principal amount, interest rate, and repayment schedule. Having this information organized can help you prioritize your debts, create a budget, and make informed decisions about your financial future.

In this guide, we’ll provide you with a free personal loan statement template that you can customize to suit your needs. We’ll also walk you through the steps to complete the template effectively, ensuring you have a clear understanding of your financial situation and can create a plan to achieve debt freedom.

What You’ll Learn:

- A step-by-step guide to creating a personal loan statement template

- The importance of tracking your loans and expenses

- Tips for prioritizing your debts and creating a budget

- A free, customizable loan statement template

In the next section, we’ll dive deeper into the benefits of using a loan statement template and provide you with the tools to get started.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a personal loan statement template?

A personal loan statement template is a document that outlines the terms and conditions of a personal loan. It typically includes information such as the borrower’s name, loan amount, interest rate, repayment period, and payment schedule.

-

Q: Why do I need a personal loan statement template?

A personal loan statement template can help you keep track of your loan obligations and ensure that you’re repaying the loan according to the agreed-upon terms. It’s especially useful if you have multiple loans with different lenders.

-

Q: Can I customize a personal loan statement template?

Yes, most personal loan statement templates are customizable. You can adjust the fields and sections to fit your specific needs and loan agreements.

-

Q: Is a personal loan statement template only for borrowers?

No, a personal loan statement template is useful for both borrowers and lenders. Lenders can use it to track their loans and ensure that borrowers are repaying them on time.

Conclusion

In this comprehensive guide, we’ve walked you through the importance of creating a personal loan statement template and provided you with a free, customizable template to help you take control of your finances. By using this template, you’ll be able to track your loans, prioritize your debts, and create a plan to achieve debt freedom.

Remember, managing multiple loans can be overwhelming, but with the right tools and strategies, you can get back on track. Take the first step towards financial clarity by downloading our free personal loan statement template and starting your journey to debt-free living today.

Calculate multiple student loan payoff: Want to get out of debt quickly? Learn how to calculate your student loan payoff and create a personalized plan to tackle multiple loans at once. Discover the secrets to becoming debt-free in no time!