Government Student Loan Exit Counseling: A Comprehensive Guide

Are you struggling to make sense of your government student loan exit counseling requirements? You’re not alone. With the increasing burden of student debt on today’s graduates, understanding how to navigate the process of repaying federal loans can be a daunting task.

In this comprehensive guide, we’ll take the mystery out of government student loan exit counseling and provide you with a clear roadmap for successfully navigating the repayment process. Whether you’re just starting out or nearing the end of your repayment journey, our expert guidance will help you:

• Understand the importance of exit counseling

• Learn how to complete the required counseling session

• Discover strategies for managing debt and achieving financial stability

• Explore options for loan forgiveness, consolidation, and repayment

So, what are you waiting for? Dive into our comprehensive guide on government student loan exit counseling today and start taking control of your financial future!

Government Student Loan Exit Counseling: A Comprehensive Guide

In the United States, student loan debt has reached an all-time high, with millions of borrowers struggling to make ends meet. As a result, understanding how to navigate the repayment process is crucial for achieving financial stability and avoiding default.

The Department of Education requires students who have received federal student loans to complete exit counseling before leaving school or dropping below half-time enrollment. This process may seem daunting at first, but it’s designed to educate borrowers on their loan obligations and provide them with the tools necessary to manage their debt successfully.

So, what is government student loan exit counseling? Simply put, it’s a mandatory session that provides important information about your federal loans, including:

- The total amount borrowed

- The interest rates and repayment terms for each loan

- The consequences of defaulting on a loan

- Strategies for managing debt and achieving financial stability

- Options for loan forgiveness, consolidation, and repayment

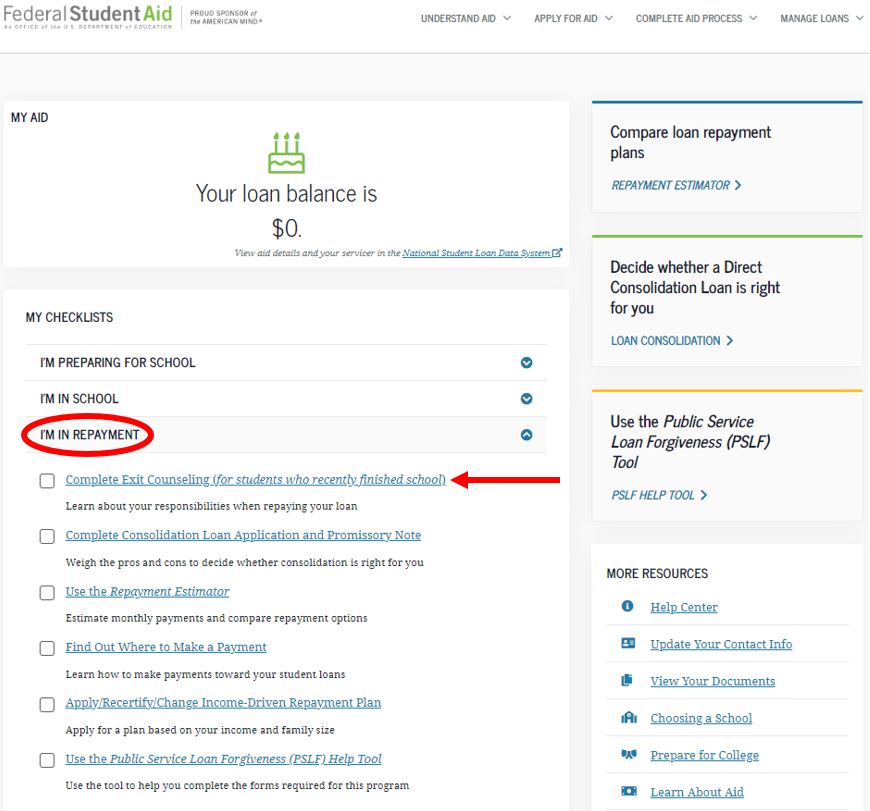

To complete the required counseling session, borrowers can either:

- Contact their school’s financial aid office or student loan servicer to schedule a phone or in-person session

- Complete an online exit counseling session through the National Student Loan Data System (NSLDS) website (1)

In addition to understanding your loan obligations, it’s essential to develop a solid plan for managing your debt. This includes:

- Creating a budget that prioritizes debt repayment

- Consolidating or refinancing high-interest loans to lower monthly payments

- Exploring income-driven repayment plans or forgiveness programs

- Building an emergency fund to avoid defaulting on a loan

By completing government student loan exit counseling and developing a thoughtful plan for managing debt, borrowers can set themselves up for long-term financial success. In our next section, we’ll delve deeper into strategies for managing debt and achieving financial stability.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

-

What is the purpose of government student loan exit counseling?

The primary goal of government student loan exit counseling is to educate borrowers on their repayment options and responsibilities after graduating or leaving school. This process helps individuals understand how to manage their debt, avoid default, and make informed decisions about their financial futures.

-

Who is required to participate in government student loan exit counseling?

Typically, students who have taken out federal student loans as part of the William D. Ford Federal Direct Loan Program or other federally funded programs are required to complete an exit counseling session before graduating or dropping below half-time enrollment.

-

What topics are typically covered during government student loan exit counseling?

Exit counseling sessions usually cover key information about the borrower’s federal student loans, including:

- The total amount of outstanding debt

- The types of repayment plans available (e.g., standard, graduated, extended)

- The options for deferment and forbearance

- The consequences of defaulting on a loan

- Resources for finding financial assistance and budgeting advice

-

Can I still access government student loan exit counseling if I’ve already graduated or left school?

While the requirement to complete an exit counseling session typically applies during enrollment, you can still take advantage of this resource if you’re struggling with debt repayment. Contact your lender or a financial aid professional for guidance on accessing exit counseling at any time.

Conclusion

In today’s increasingly complex financial landscape, understanding government student loan exit counseling is crucial for achieving long-term financial stability and avoiding default. By completing this mandatory session, borrowers can gain a deeper understanding of their federal loans, including repayment options, interest rates, and potential consequences.

As we’ve explored in this comprehensive guide, government student loan exit counseling provides vital information and resources to help borrowers navigate the repayment process with confidence. Whether you’re just starting out or nearing the end of your repayment journey, our expert guidance has equipped you with the knowledge and strategies necessary for achieving financial success.

Remember, taking control of your federal student loans is a critical step in securing a brighter financial future. By developing a solid plan for managing debt and exploring options for loan forgiveness, consolidation, and repayment, you can set yourself up for long-term prosperity.

In conclusion, government student loan exit counseling is an essential process that empowers borrowers to make informed decisions about their financial futures. By understanding your loan obligations, developing a thoughtful plan for debt management, and taking advantage of available resources, you can achieve financial stability and avoid the pitfalls of default.

Same day payday loans online instant cash relief: Get immediate financial assistance with same-day payday loans, perfect for unexpected expenses or emergencies. Find out how to apply and get the cash you need quickly.

Are student loans subsidized: Wondering if your student loan is subsidized? Learn about the different types of federal student loans, including subsidized and unsubsidized options. Discover how to manage your debt and make the most of your education.

Easy online personal loans for bad credit: Need a loan but have poor credit? Find out how to qualify for easy online personal loans, even with bad credit. Get tips on improving your credit score and applying for the right loan for your needs.