Information On Student Loans For College

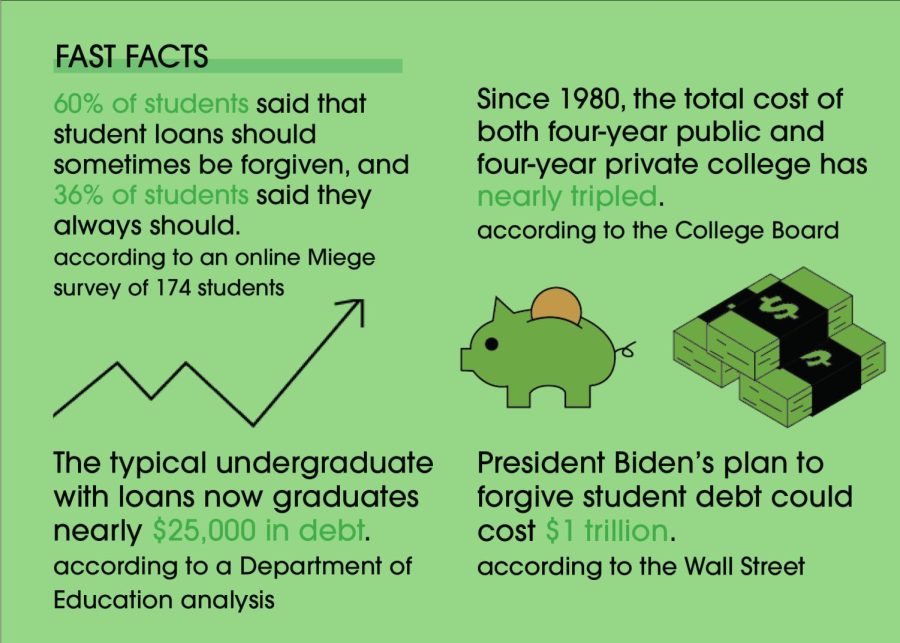

Are you a prospective college student struggling to find the right financial solution for your education? You’re not alone! The cost of higher education can be overwhelming, making it difficult to afford tuition fees without taking out loans. In fact, according to recent statistics, nearly 70% of students in the United States rely on student loans to fund their higher education.

Understanding Student Loans for College

In this digital age, having a degree is no longer a luxury but a necessity to succeed in today’s competitive job market. However, with the rising cost of tuition fees, many students are finding it challenging to fund their education without taking out loans. This is where information on student loans for college comes into play.

This guide aims to provide you with valuable insights and information about student loans, helping you make informed decisions about your financial future. From federal student loans to private lenders, we’ll cover everything you need to know to secure the funds you need to pursue your higher education goals.

Information On Student Loans For College

Are you a prospective college student struggling to find the right financial solution for your education? You’re not alone! The cost of higher education can be overwhelming, making it difficult to afford tuition fees without taking out loans. In fact, according to recent statistics, nearly 70% of students in the United States rely on student loans to fund their higher education.

Understanding Student Loans for College

In this digital age, having a degree is no longer a luxury but a necessity to succeed in today’s competitive job market. However, with the rising cost of tuition fees, many students are finding it challenging to fund their education without taking out loans. This is where information on student loans for college comes into play.

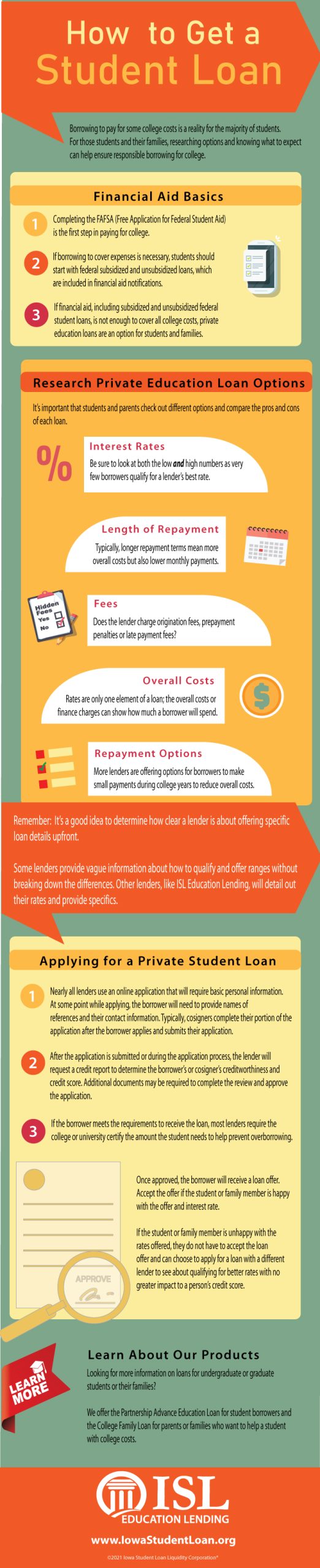

Student loans can be categorized into two main types: federal and private. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, provide low-interest rates and flexible repayment terms. On the other hand, private student loans are offered by banks, credit unions, and online lenders, often with variable interest rates and stricter repayment terms.

The U.S. Department of Education’s Federal Student Aid office offers a comprehensive guide to federal student loans, including information on eligibility, application processes, and loan forgiveness programs.This guide aims to provide you with valuable insights and information about student loans, helping you make informed decisions about your financial future. From federal student loans to private lenders, we’ll cover everything you need to know to secure the funds you need to pursue your higher education goals.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFAQs: Information On Student Loans For College

-

Q: What types of student loans are available for college?

A: There are several types of student loans available, including federal student loans, private student loans, and institutional loans. Federal student loans include Direct Subsidized and Unsubsidized Loans, as well as PLUS Loans for graduate students. Private student loans can be offered by banks, credit unions, or other lenders.

-

Q: How do I apply for a federal student loan?

A: To apply for a federal student loan, you’ll need to complete the Free Application for Federal Student Aid (FAFSA) form. You can submit the FAFSA online at fafsa.gov or by mail. Your school’s financial aid office will then use your FAFSA information to determine your eligibility for federal student loans.

-

Q: What is the difference between subsidized and unsubsidized federal student loans?

A: Subsidized federal student loans are need-based, meaning they’re only offered to students who demonstrate financial need. The government pays the interest on these loans while you’re in school. Unsubsidized federal student loans, on the other hand, are not based on need and do accrue interest while you’re enrolled.

-

Q: Can I consolidate my student loans?

A: Yes, you can consolidate your student loans through a process called federal consolidation. This involves combining multiple federal student loans into one loan with a single interest rate and monthly payment. Consolidation can simplify your payments and potentially lower your overall interest rate.

Conclusion

In conclusion, student loans can be a valuable resource for funding your higher education goals. By understanding the different types of federal and private student loans available, you’ll be better equipped to make informed decisions about your financial future. Whether you’re a prospective college student or already navigating the complexities of student loan debt, this guide aims to provide you with the information and resources you need to secure the funds you need to pursue your academic aspirations.

Same day payday loans online instant cash relief: Get immediate financial assistance with same-day payday loans. No need to wait for funds, as these loans provide quick and easy access to cash when you need it most.

Same day funding California payday loans – no credit check direct lender: Looking for a reliable way to get cash in California? Same-day funding payday loans offer fast and easy access, with no credit checks required. Perfect solution when you’re short on funds!

Ace payday loans Cody WY: In a financial pinch in Cody, Wyoming? Ace payday loans provide quick and easy access to cash, with no hassle or hidden fees. Click to learn more!