Is It Better to Get a Federal or Private Student Loan?

Are you struggling to fund your education expenses? If so, you’re not alone. Many students face financial constraints when pursuing higher education, and student loans often seem like the only viable option. With so many types of student loans available, it’s essential to understand the differences between federal and private student loans before making a decision.

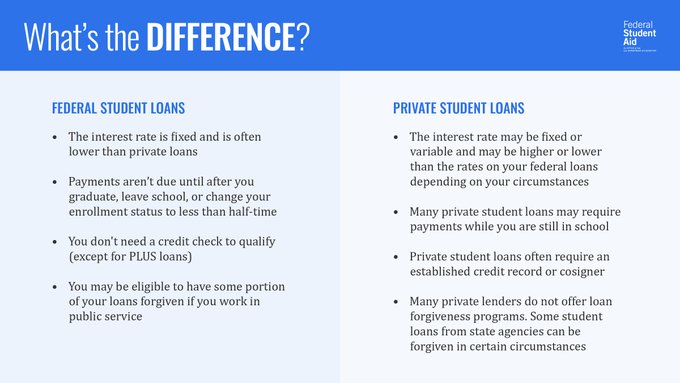

While both options can provide much-needed financial assistance, there are distinct advantages and disadvantages to consider. Federal student loans, for example, offer more favorable terms, such as lower interest rates and more flexible repayment options. On the other hand, private student loans may offer higher loan limits and more lenient credit requirements.

In this article, we’ll delve into the specifics of federal and private student loans to help you determine which one is better for your financial situation. Whether you’re a college freshman or an adult looking to further their education, understanding the pros and cons of each option will empower you to make informed decisions about your borrowing options.

Is It Better to Get a Federal or Private Student Loan?

Are you struggling to fund your education expenses? If so, you’re not alone. Many students face financial constraints when pursuing higher education, and student loans often seem like the only viable option. With so many types of student loans available, it’s essential to understand the differences between federal and private student loans before making a decision.

Federal student loans are backed by the government and offer more favorable terms, such as lower interest rates like 4.53% for subsidized and unsubsidized direct loans, and more flexible repayment options, including income-driven repayment plans like Income-Based Repayment (IBR). Additionally, federal student loans often have built-in forgiveness programs, such as Public Service Loan Forgiveness (PSLF) .

On the other hand, private student loans are offered by banks and other financial institutions. They may offer higher loan limits and more lenient credit requirements than federal loans, but often come with higher interest rates and less flexible repayment terms. Some private lenders also offer additional benefits, such as rewards programs or career counseling.

Before making a decision, it’s essential to weigh the pros and cons of each option. If you’re unsure which type of loan is best for your situation, consider consulting with a financial aid expert or seeking guidance from your school’s financial aid office.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

Q: What is the difference between a federal student loan and a private student loan?

A: Federal student loans are offered by the government, such as the Direct Subsidized and Unsubsidized Loans and the Perkins Loan. Private student loans, on the other hand, are offered by banks, credit unions, or other financial institutions. The main difference is that federal loans have more favorable terms, such as lower interest rates and more flexible repayment options.

In conclusion, both federal and private student loans have their own advantages and disadvantages. Federal student loans offer more favorable terms, such as lower interest rates and more flexible repayment options, but may have stricter eligibility requirements and loan limits. Private student loans, on the other hand, may offer higher loan limits and more lenient credit requirements, but often come with higher interest rates and less flexible repayment terms.

Ultimately, the decision between a federal and private student loan depends on your individual financial situation and goals. If you’re unsure which type of loan is best for you, consider consulting with a financial aid expert or seeking guidance from your school’s financial aid office. By understanding the pros and cons of each option, you’ll be better equipped to make an informed decision about how to fund your education expenses.

Can i still deduct student loan interest: Did you know that you may still be eligible to deduct student loan interest from your taxes? Learn more about the qualifications and how it can help you save money. Click here to find out if you’re eligible!