Unlock the Power of Personal Loans: Main Financial’s One Loan Rates

If you’re struggling to manage your finances or find a way to consolidate debt, you’re not alone. In today’s fast-paced world, unexpected expenses and financial setbacks can leave us feeling overwhelmed and unsure of how to move forward. That’s where personal loans come in – a quick and effective solution for tackling those pesky debts.

But Where Do You Start?

With so many loan options available, it can be daunting to find the right one that fits your budget and financial goals. This is especially true when you’re bombarded with ads and promotions from various lenders claiming to offer the best rates and terms. The truth is, understanding personal loan rates and options is crucial in making an informed decision that won’t break the bank.

In this article, we’ll delve into the world of Main Financial’s One Loan Rates, exploring what makes them a top choice for those seeking financial freedom. From competitive interest rates to flexible repayment terms, discover how you can unlock the power of personal loans and start building a brighter financial future today!

Main Financial: One Personal Loan Rates

A personal loan can be a lifesaver when you’re struggling to manage debt or need a financial boost. With so many loan options available, it’s essential to understand the ins and outs of personal loan rates to make an informed decision.

What Are Personal Loan Rates?

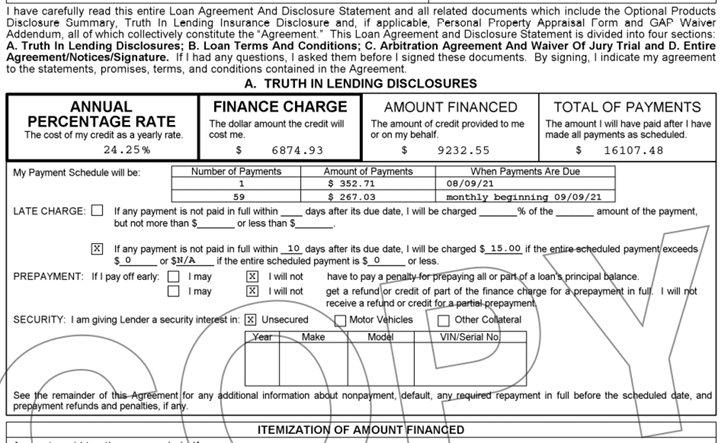

A personal loan rate is the interest rate charged on a loan, expressed as a percentage over a specific period. It’s crucial to know that personal loan rates vary depending on factors such as credit score, loan amount, and repayment term.

For instance, according to the Federal Reserve, the average annual percentage rate (APR) for personal loans in the United States is around 10%. However, rates can range from as low as 6% APR to as high as 30% APR or more. [1]

How Are Personal Loan Rates Calculated?

Personal loan rates are typically calculated using a combination of factors, including:

- Credit score: A higher credit score can lead to lower interest rates.

- Loan amount: Larger loans often come with higher interest rates.

- Repayment term: Shorter repayment terms may have higher interest rates.

- Lender’s risk assessment: Some lenders may charge higher interest rates based on their perceived level of risk.

It’s essential to understand that personal loan rates can change over time, and lenders may adjust their rates in response to market conditions. [2]

What Should You Consider When Choosing a Personal Loan?

When selecting a personal loan, consider the following factors:

- Interest rate: Look for competitive interest rates that align with your financial goals.

- Fees: Be aware of any fees associated with the loan, such as origination or late payment fees.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a personal loan rate?

A: A personal loan rate refers to the interest rate charged on a personal loan, typically expressed as an annual percentage rate (APR). It represents the cost of borrowing money from a lender.

-

Q: How are personal loan rates determined?

A: Personal loan rates are determined by various factors, including your credit score, income, debt-to-income ratio, and loan term. Lenders use these factors to assess the level of risk involved in lending to you.

-

Q: What is a good personal loan rate?

A: A good personal loan rate typically ranges from 6% to 12%. However, rates can vary depending on the lender and your individual financial situation. It’s essential to shop around and compare rates from multiple lenders to find the best deal.

-

Q: Can I negotiate a personal loan rate?

A: Yes, you can try negotiating a personal loan rate with some lenders. This may involve discussing your creditworthiness, income, or other factors that could impact the interest rate. However, be aware that not all lenders offer rate negotiations.

Conclusion: Unlocking the Power of Personal Loans

In today’s fast-paced world, managing finances can be overwhelming, and debt can feel like a burden. However, with the right tools and knowledge, you can unlock the power of personal loans to tackle those pesky debts and build a brighter financial future.

By understanding personal loan rates and options, you can make an informed decision that won’t break the bank. Whether you’re looking to consolidate debt or need a financial boost, Main Financial’s One Loan Rates can be a valuable resource in your journey towards financial freedom.

Same day deposit online payday loans fast access to emergency funds: Need cash now? Same day deposit online payday loans can provide you with the financial support you need. Learn how these loans work and why they’re a great solution for unexpected expenses.

Income-based repayment plans for student loans the marriage factor: Are you struggling to make ends meet while paying off your student loans? Discover how income-based repayment plans can help, and explore the added benefits that come with being married.

Bad credit personal loans a solution for Ottawa residents: If you’re an Ottawa resident dealing with bad credit, don’t worry! We’ve got the solution. Learn how to improve your credit score and find out if bad credit personal loans are right for you.