Negotiate a Settlement for Your Outstanding Debt: Take Control of Your Finances

Are you tired of living with the weight of outstanding debt? Do you feel overwhelmed by the constant pressure to make payments, pay interest, and try to stay on top of your financial obligations? You’re not alone. Millions of people struggle with debt every year, but there is hope. One powerful tool in your arsenal is negotiating a settlement for your outstanding debt.

In this increasingly complex financial landscape, knowing how to negotiate a settlement can be the key to unlocking true financial freedom. By understanding the process and leveraging the right strategies, you can reduce the amount of debt you owe, lower your payments, and start rebuilding your credit score.

This guide will walk you through the steps necessary to successfully negotiate a settlement for your outstanding debt, giving you the tools and confidence you need to take control of your finances and start building a brighter financial future.

Discover How to:

- Navigate the complex process of negotiating a debt settlement

- Maximize your savings and minimize the impact on your credit score

- Build a strong case for your settlement request

- Make informed decisions about your financial future

In the next section, we’ll dive deeper into the benefits of negotiating a debt settlement and explore the steps you can take to get started.

Negotiate a Settlement for Your Outstanding Debt: Take Control of Your Finances

Are you tired of living with the weight of outstanding debt? Do you feel overwhelmed by the constant pressure to make payments, pay interest, and try to stay on top of your financial obligations? You’re not alone. According to the Federal Reserve, outstanding debt in the United States has reached a record high. However, there is hope. One powerful tool in your arsenal is negotiating a settlement for your outstanding debt.

In this increasingly complex financial landscape, knowing how to negotiate a settlement can be the key to unlocking true financial freedom. By understanding the process and leveraging the right strategies, you can reduce the amount of debt you owe, lower your payments, and start rebuilding your credit score.

A debt settlement occurs when you and your creditor agree on a lump-sum payment that is less than the original amount owed. This can be a viable option for individuals who are struggling to make payments or have experienced financial hardship. For example, if you owe $10,000 on a credit card with an interest rate of 20%, a debt settlement could result in a reduced payment of $5,000.

This guide will walk you through the steps necessary to successfully negotiate a settlement for your outstanding debt, giving you the tools and confidence you need to take control of your finances and start building a brighter financial future. We’ll cover topics such as:

Discover How to:

- Navigate the complex process of negotiating a debt settlement

- Maximize your savings and minimize the impact on your credit score

- Build a strong case for your settlement request

- Make informed decisions about your financial future

In the next section, we’ll dive deeper into the benefits of negotiating a debt settlement and explore the steps you can take to get started.

Struggling with Debt? Settle for Less Today!

Reduce Your Debt by Up to 50% – Speak with a Specialist Now!

💬 Start Free ChatFAQ: Negotiating a Settlement for Your Outstanding Debt

-

Q: What is debt settlement and how does it work?

A: Debt settlement, also known as debt negotiation or credit settlement, is an agreement between you and your creditor to pay less than the full amount of your outstanding debt. This can be a one-time payment or a series of payments over time.

-

Q: Who is eligible for debt settlement?

A: Anyone with outstanding debt, regardless of the type (credit card, loan, mortgage, etc.), may be eligible for debt settlement. However, not all creditors participate in settlements, and some debts may have specific requirements or restrictions.

-

Q: What are the benefits of negotiating a settlement?

A: The main benefits include reducing your overall debt amount, stopping creditor harassment, and potentially improving your credit score by avoiding bankruptcy or other negative marks. Additionally, settlements can help you avoid paying interest rates that continue to accrue.

-

Q: How do I determine if a settlement is the right choice for me?

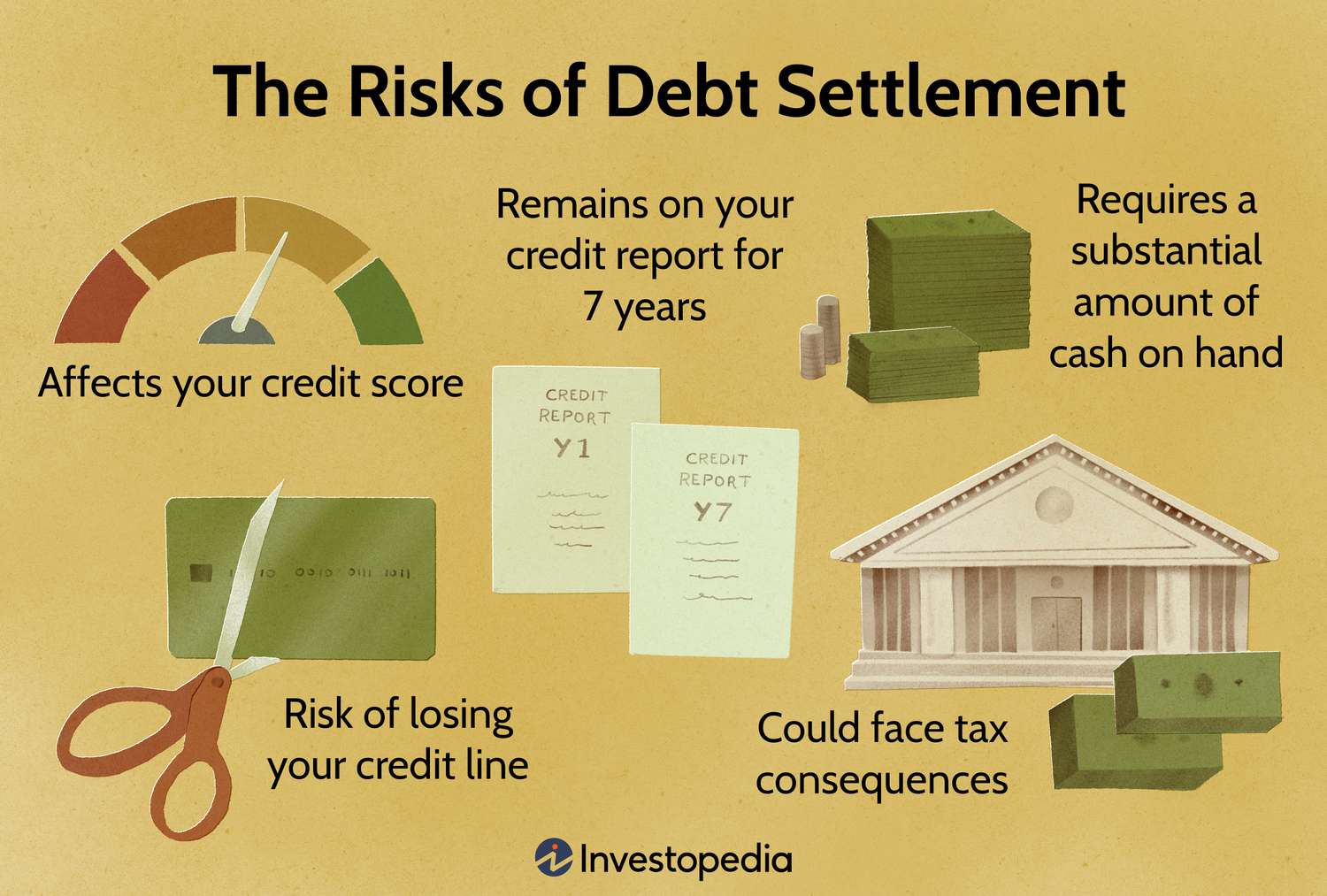

A: Consider your financial situation, debt-to-income ratio, and credit score. If you’re struggling to make payments or have a large amount of debt, a settlement might be a viable option. It’s essential to weigh the potential benefits against any potential risks or consequences.

-

Q: Can I negotiate a settlement with all creditors?

A: No, not all creditors participate in settlements. Some may have specific requirements or restrictions, while others might be more open to negotiations. It’s crucial to research and understand the terms and limitations before pursuing a settlement.

Negotiating a Settlement for Your Outstanding Debt: Taking Control of Your Finances

In conclusion, negotiating a settlement for your outstanding debt can be a powerful tool to unlock true financial freedom. By understanding the process and leveraging the right strategies, you can reduce the amount of debt you owe, lower your payments, and start rebuilding your credit score.

This guide has walked you through the steps necessary to successfully negotiate a settlement for your outstanding debt, giving you the tools and confidence you need to take control of your finances and start building a brighter financial future.

Whether you’re struggling to make payments or have experienced financial hardship, a debt settlement can be a viable option. By understanding the benefits and limitations of this process, you can make informed decisions about your financial future and take control of your outstanding debt.

Ecmc Student Loan Collections Expert Guidance for Managing Debts: Don’t let ECMC student loan debt collections get the best of you! Get expert guidance on managing your debts and learn how to negotiate with collectors to reduce your payments. Read now to take control of your finances.