Payday Loan with Prepaid Card Near Me: A Convenient Financial Solution

Are you tired of living paycheck to paycheck, struggling to make ends meet before your next paycheque arrives? Do you find yourself constantly worrying about how you’ll cover unexpected expenses or financial emergencies?

If so, you’re not alone. Millions of people around the world face similar challenges every day. But what if there was a way to access the funds you need quickly and easily, without the hassle of credit checks or lengthy loan applications? Enter payday loans with prepaid cards near me – a convenient financial solution that’s changing the game.

In this article, we’ll explore the benefits of payday loans with prepaid cards, how they work, and why they’re an attractive option for those in need of fast cash. So, if you’re ready to break free from the cycle of financial stress and uncertainty, keep reading!

Payday Loan with Prepaid Card Near Me: A Convenient Financial Solution

Are you tired of living paycheck to paycheck, struggling to make ends meet before your next paycheque arrives? Do you find yourself constantly worrying about how you’ll cover unexpected expenses or financial emergencies?

If so, you’re not alone. According to the Federal Reserve, 40% of Americans don’t have enough savings to cover a $400 emergency expense [1]. The reality is that financial stress is a widespread issue that affects millions of people worldwide. But what if there was a way to access the funds you need quickly and easily, without the hassle of credit checks or lengthy loan applications? Enter payday loans with prepaid cards near me – a convenient financial solution that’s changing the game.

Payday loans with prepaid cards allow individuals to borrow small amounts of money, typically ranging from $100 to $1,000, against their next paycheck. The funds are loaded onto a prepaid debit card, which can be used to cover unexpected expenses or financial emergencies. This type of loan is designed to provide fast and easy access to cash, with no credit check required [2].

So, how do payday loans with prepaid cards work? Here’s a step-by-step guide:

- You apply for a payday loan online or in-person

- You provide basic personal and employment information

- Your application is reviewed and approved by the lender

- The funds are loaded onto a prepaid debit card

- You can use the prepaid card to access your funds at participating ATMs, stores, or online retailers

- The loan amount plus interest and fees is deducted from your next paycheck

In summary, payday loans with prepaid cards near me offer a convenient financial solution for individuals facing unexpected expenses or financial emergencies. With no credit check required and fast access to cash, this type of loan can be an attractive option for those in need of fast funds.

🚀 Get Up to $1,500 in Minutes – No Credit Check!

Need Cash Urgently? Free Chat with a Loan Expert Now/p> Get Instant Approval – Chat Now!

Frequently Asked Questions

-

Q: What is a payday loan with a prepaid card?

A payday loan with a prepaid card is a type of short-term loan that provides quick access to cash. The loan is deposited directly onto a prepaid debit card, which can be used for purchases or withdrawn at an ATM.

-

Q: How do I qualify for a payday loan with a prepaid card?

To qualify for a payday loan with a prepaid card, you typically need to meet certain requirements. These may include being at least 18 years old, having a steady income or job, and having a valid government-issued ID.

-

Q: What is the typical interest rate for a payday loan with a prepaid card?

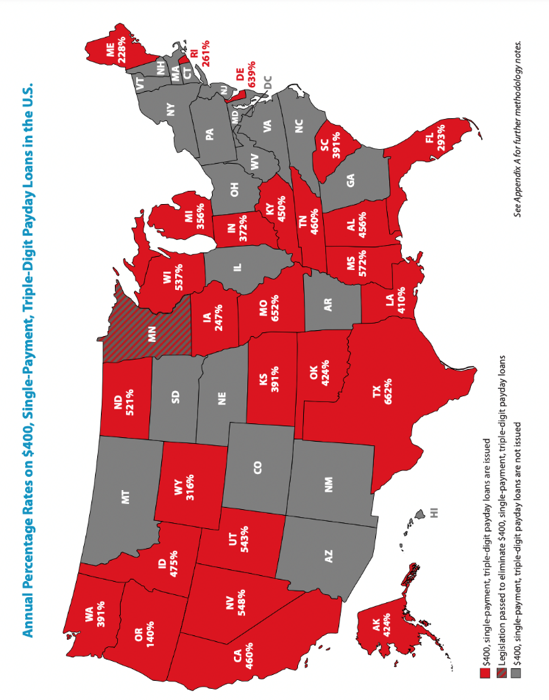

The interest rates for payday loans with prepaid cards vary depending on the lender and your location. However, they are generally higher than those of traditional bank loans or credit cards. In some cases, annual percentage rates (APRs) can range from 300% to over 500%

-

Q: How long do I have to pay back a payday loan with a prepaid card?

The repayment period for a payday loan with a prepaid card typically ranges from a few days to several weeks or months. The exact timeframe will depend on the lender’s policies and your agreement.

Conclusion

In conclusion, payday loans with prepaid cards near me offer a convenient financial solution for individuals facing unexpected expenses or financial emergencies. With no credit check required and fast access to cash, this type of loan can be an attractive option for those in need of quick funds.

The benefits of payday loans with prepaid cards include:

- Fast and easy access to cash

- No credit check required

- Convenient repayment terms

While payday loans with prepaid cards can be a helpful financial tool, it’s essential to use them responsibly and only as a last resort. It’s crucial to carefully review the loan terms, interest rates, and fees before agreeing to the loan.

In summary, payday loans with prepaid cards near me offer a convenient financial solution for individuals facing unexpected expenses or financial emergencies. With careful consideration and responsible usage, this type of loan can be an attractive option for those in need of quick funds.

Citizen Bank Refinance Student Loans: Simplify Your Education Debt: Are you tired of juggling multiple student loan payments? Citizen Bank offers a refinancing solution to simplify your education debt and take control of your finances. Learn more about how they can help you consolidate and pay off your loans faster.

Biden’s Student Loan Solution: Expert Insights on His Approach to Higher Education: The Biden administration has proposed a student loan solution aimed at addressing the growing crisis of education debt. Get expert insights into his approach and learn how it can impact your financial future.

Get the Best Rates on Student Loans: Are you struggling to find a student loan with competitive rates? Our expert guide will help you navigate the process and get approved for the best interest rates. Learn how to optimize your loan application and start building a stronger financial future.